Borrowell | Fintech

Borrowell - Credit Report & Credit Score Provider

The Company

Borrowell serves over a million Canadians by allowing comprehensive access to credit history via its website. Analytics indicated that users often log into the website and consistently return in anticipation of a refreshed credit score alongside tailored product recommendations.

Many of Borrowell’s competitors have begun to address similar increases in engagement by venturing into the mobile space, as apps can offer greater utility than their web-based counterparts. In response, Borrowell wanted to support the immediacy of information sought after by their customers with a mobile app, extending their digital reach.

My Role: Associate Director of Product

Tools & Methods: Design Strategy | Planning & Roadmapping | DesignOps & Leadership | Discovery & Research | Experience Design | Usability Testing | Content Strategy | Acceptance Criteria

The Task: Website Redesign & Mobile App Design

Borrowell provides members with easy access to their credit history, with the website acting as the sole source of traffic for monitoring credit profiles. Since 75% of traffic to their site was from mobile devices, Borrowell knew they needed a world-class mobile application to compete with other providers in their category. They also needed the capability to integrate upcoming digital services within the mobile platform.

Borrowell’s existing website faced a number of challenges that prevented the FinTech from bringing in revenue through their full repertoire of product offerings including loans, credit cards, and more. Those challenges included:

- Under performant keywords and search engine optimization (SEO) relative to competitors, leading to a loss in organic traffic

- High spending on digital advertising

- There is a mismatch in the user experience between the website, applications, and the overall brand

- Gated content limiting potential consumer exposure to Borrowell’s offerings and benefits

- Outdated and counter-intuitive website design and layout with little informative content

- Lack of compliance with AA accessibility standards

The Process

With a deep understanding of the business ecosystem and customer needs, the cross-functional engineers and designers collaborated to deliver the application. With the foundation of knowledge in place, the team drafted a plan to create a design language that would support the Visual Design standards for the new app experience. At the same time, we mapped the overall functionality and use cases for an accessible, best-in-class app that prioritized the user’s needs.

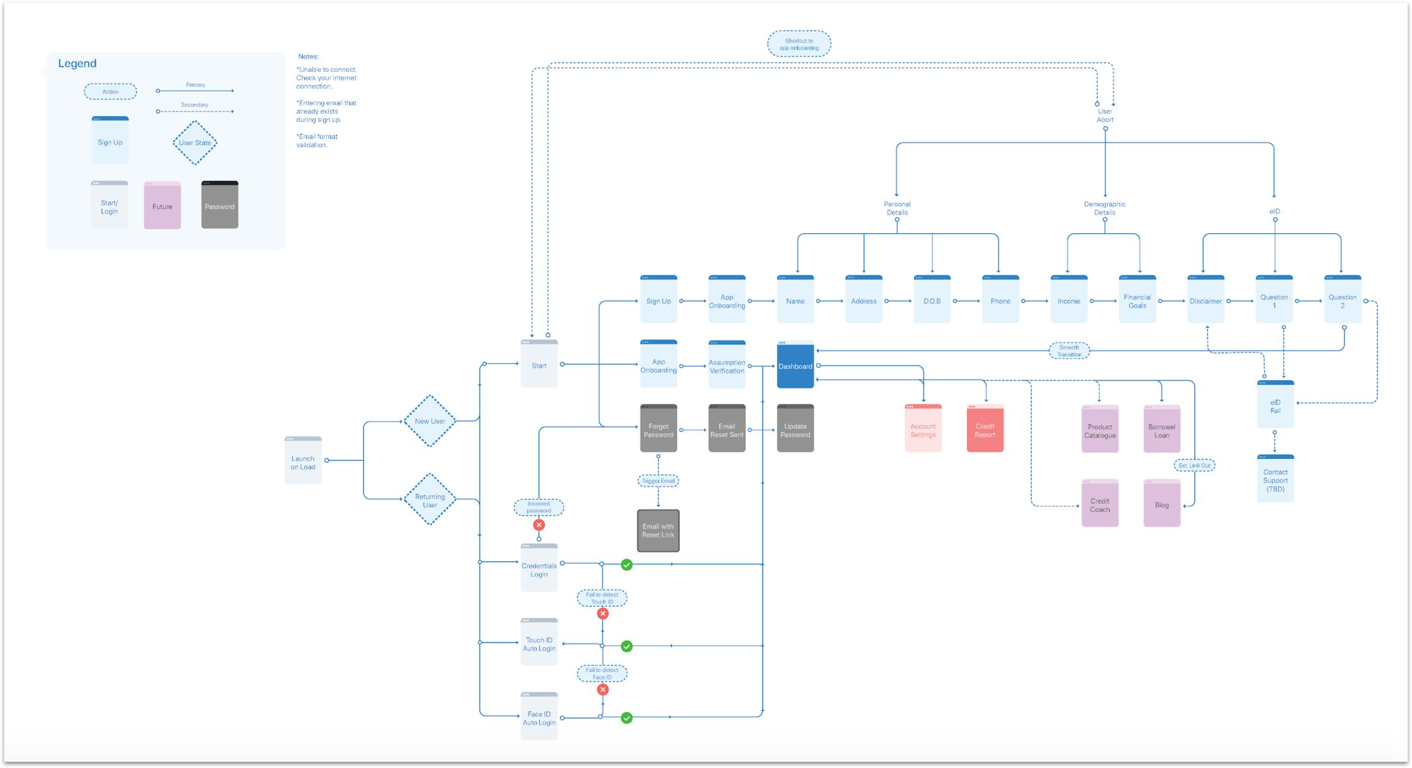

During the process, the team implemented continuous testing, rapid delivery cycles, and a focus on designing and developing for accessibility to ensure that the largest possible audience could access and use the app. In proposing a solution that would scale to hook into the existing online business platform, my team and I mapped out a series of flows that would support a connected system of action pathways for members, including:

Sign up and log in

Onboarding and biometrics setup

Retrieval of credit score and report

Exploration of product recommendations

Prediction of content and content adaptations based on user activity

Borrowell App user flow

My team worked closely with Borrowell to learn about how their predictive AI-powered platform makes recommendations to its members. To do this, we did a deep dive into subjects including:

Credit score makeup and impact

Equifax security requirements

Product approval likelihood algorithms

Improving credit and financial literacy

Targeted marketing and API integration

Establishing Documentation Standards

In order for my team to hit the ground running, I wanted to create efficient and valuable templates and centralized documentation within the client’s Atlassian Suite (Confluence and Jira). I was able to create an organized hub that showcased process and progress. Doing so allowed my team to seamlessly mobilize research into actionable design and development tasks.

Establishing a Design Framework

Post-discovery, my team and I worked with Borrowell to define a design language that would evolve the current Visual Design standards of the website to a best-in-class mobile app experience.

Simultaneously, we designed wireframes and mockups to illustrate the overall functionality and usage of the app.

Employing Regular Testing

Our research efforts continued well beyond the Discovery phase--I planned regular usability testing with members of Borrowell’s user base as well as internal stakeholders.

Ongoing research activities included:

Test recruitment

Drafting test plans

Conducting test sessions

Synthesizing actionable feedback

Implementing feedback into delivery cycles

Designing for Accessibility Through Development

My team and I worked tightly with the developers to convert design palettes into common components with accessibility properties. We were able to systematically optimize:

Colour contrast

Target sizes for hotspots

Alt text and ARIA labels

Global navigation

A Best-In-Class Mobile App Experience

Through our work, we helped Borrowell expand its reach, attract and convert visitors, improve its SEO ranking, and educate potential and real clients on its extensive product offering. The website rebuild and design dramatically increased Borrowell’s scores across the board, as determined by a Lighthouse Audit. Working at Borrowell while embedded with their teams, my team and I were able to conduct research and form a tactical design strategy to execute on. This led to the design and development of a native mobile app that brings the Borrowell experience to iOS and Android devices, with features including:

Biometric login (Fingerprint and Face ID)

Push notifications

Custom webview for external links

Google Cards paradigm

Shipped a best-in-class mobile app that ranks #30 among finance apps in the App Store, rated 4.8 out of 5 across both the App Store and Google Play with over 5k reviews and over 50k downloads